Maximizing Solar Tax Credits: Exploring Transfers for Cash under the Inflation Reduction Act

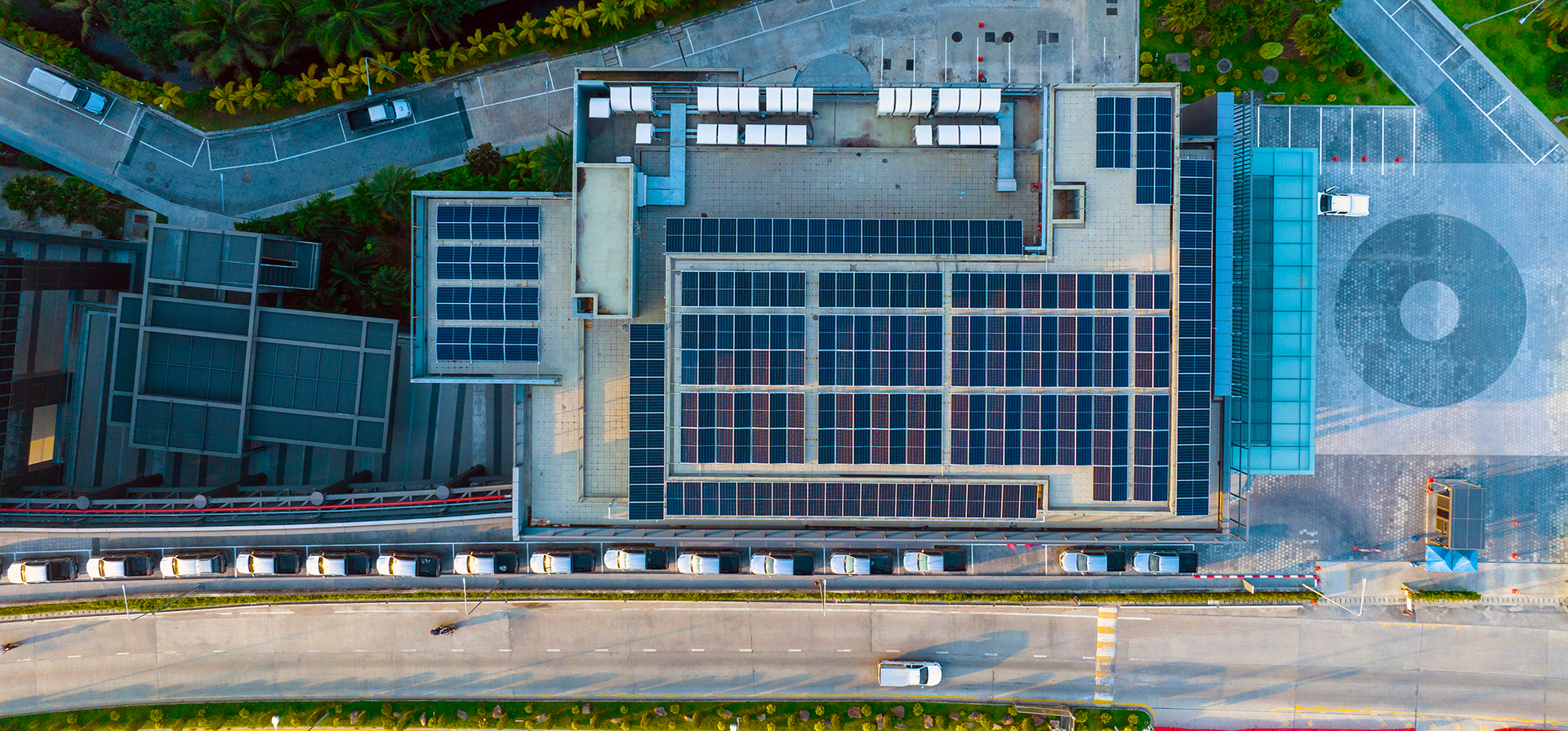

Solar energy has gained immense popularity in recent years, not only for its environmental benefits but also for the financial incentives it offers. One such incentive is the solar tax credit, which allows homeowners and businesses to claim a substantial credit for installing solar energy systems. The Inflation Reduction Act has introduced a new provision that allows for the transfer of solar tax credits for cash. In this blog post, we will delve into the details of this provision and explain how it can benefit taxpayers.

Understanding the Inflation Reduction Act:

The Inflation Reduction Act, signed into law in recent years, introduced significant changes to tax regulations, including an expanded provision for transferring certain tax credits. This provision specifically benefits taxpayers who have claimed solar tax credits and are looking for ways to monetize them effectively.

Transferring Solar Tax Credits for Cash:

Under the Inflation Reduction Act, homeowners and businesses that have claimed solar tax credits now have the option to transfer those credits to other eligible taxpayers in exchange for cash. This transferability allows taxpayers to convert their tax credits into immediate liquidity, providing a valuable financial resource.

Benefits of Transferring Solar Tax Credits for Cash:

1. Immediate Financial Benefit: By transferring solar tax credits for cash, taxpayers gain access to funds that can be used for various purposes. This includes offsetting installation costs, funding ongoing solar projects, or addressing other financial needs.

2. Unlocking Value: Some taxpayers may not be able to fully utilize their solar tax credits due to their tax liability or income limitations. Transferring these credits to other eligible taxpayers who can fully benefit from them allows for the optimal utilization of the tax credits and helps unlock their full value.

3. Streamlined Process: The Inflation Reduction Act provides clear guidelines and procedures for transferring solar tax credits for cash. Taxpayers need to adhere to the prescribed requirements, including written agreements and appropriate reporting methods, to ensure compliance with the law.

4. Encouraging Solar Investment: By facilitating the transfer of solar tax credits, the Inflation Reduction Act encourages investment in solar energy systems. It stimulates the growth of the solar industry by creating a market for tax credits, attracting potential investors, and furthering the adoption of renewable energy.

Considerations and Consultation:

While the transferability of solar tax credits for cash presents an enticing opportunity, taxpayers should carefully consider their individual circumstances and consult with tax professionals. Understanding the specific requirements, limitations, and potential tax implications is crucial before engaging in such transfers.

Conclusion:

The Inflation Reduction Act has introduced a game-changing provision for taxpayers who have claimed solar tax credits. The ability to transfer these credits for cash provides immediate financial benefits, unlocks their full value, and encourages further investment in solar energy systems. It is essential for taxpayers to evaluate this option, seek expert advice, and adhere to the prescribed procedures to ensure compliance and maximize the benefits of transferring solar tax credits for cash.

Sources:

Introduction To Transferable Tax Credits For Corporate Taxpayers